At Barclays, we understand that every financial journey is unique. Our Personal Banking services are designed to empower you to achieve your goals, whether you're saving for a home, planning for retirement, or managing your daily expenses.<br>

At Barclays, we understand that successful businesses require robust financial solutions tailored to their unique needs. Our Corporate Banking services are designed to empower your organization, providing the tools and expertise to drive growth and achieve strategic objectives.

At Barclays, we recognize that small and medium-sized enterprises (SMEs) are the backbone of the economy. Our SME Banking solutions are designed to support your growth, providing tailored financial products and expert guidance to help your business thrive.

At Barclays, we understand that life’s milestones often require financial support. Our Personal Loans are designed to help you achieve your goals, whether it’s financing a dream vacation, consolidating debt, or funding a home renovation.

Welcome to Barclays Capital Investment, where your financial aspirations meet our commitment to excellence. As a leading financial institution, we pride ourselves on providing innovative solutions and exceptional service to individuals, businesses, and communities worldwide.

Our Mission

At Barclays Capital Investment, our mission is to empower our clients to achieve their financial goals through tailored banking solutions, expert guidance, and a strong focus on innovation. We strive to build lasting relationships based on trust, integrity, and a shared commitment to success.

Our Vision

We envision a future where everyone has access to the financial tools and resources they need to thrive. By leveraging cutting-edge technology and our extensive industry expertise, we aim to redefine the banking experience, making it more accessible, efficient, and client-centric.

What We Offer

Personal Banking: Customized financial solutions designed to meet your unique needs, from savings and loans to investment opportunities.

Corporate Banking: Comprehensive services for businesses of all sizes, including financing, treasury management, and strategic advisory support.

SME Banking: Tailored banking solutions that empower small and medium-sized enterprises to grow and succeed.

Investment Services: Expert guidance and a wide range of investment products to help clients build and manage their wealth effectively.

Our Values

Integrity: We uphold the highest ethical standards in all our dealings, ensuring transparency and accountability.

Innovation: We embrace technology and creativity to deliver forward-thinking solutions that meet the evolving needs of our clients.

Client-Centricity: Our clients are at the heart of everything we do. We listen, understand, and respond to your needs with personalized service.

Community Commitment: We are dedicated to making a positive impact in the communities we serve, investing in initiatives that promote economic growth and social well-being.

Join Us on Our Journey

With a legacy of excellence and a forward-looking approach, Barclays Capital Investment is your trusted partner in navigating the financial landscape. Whether you’re an individual seeking to enhance your financial future or a business looking to grow, we are here to support you every step of the way.

The client perspective depends on Business first growth.

Protection against DDoS attacks, full data encryption

Providing services in 99% countries around all the globe

Popular methods: Visa, MasterCard, bank transfer, cryptocurrency

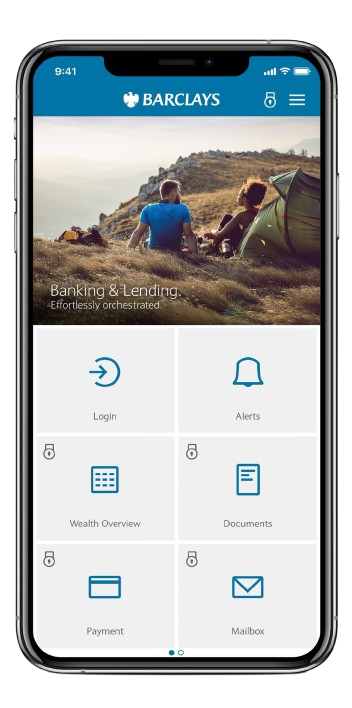

Trading via our Mobile App, Available in Play Store & App Store

Reasonable trading fees for takers and all market makers

Fast access to high liquidity orderbook for top currency pairs

Veniam laudantium cumque quasi, fuga magni esse.

The best price we only can ask for you.

The client perspective depends on Business first growth. How big business can be. We provide best service all area.

Stay updated with the latest news and tips! Get insights and advice to keep you informed and ahead of the curve.